All About 1099s

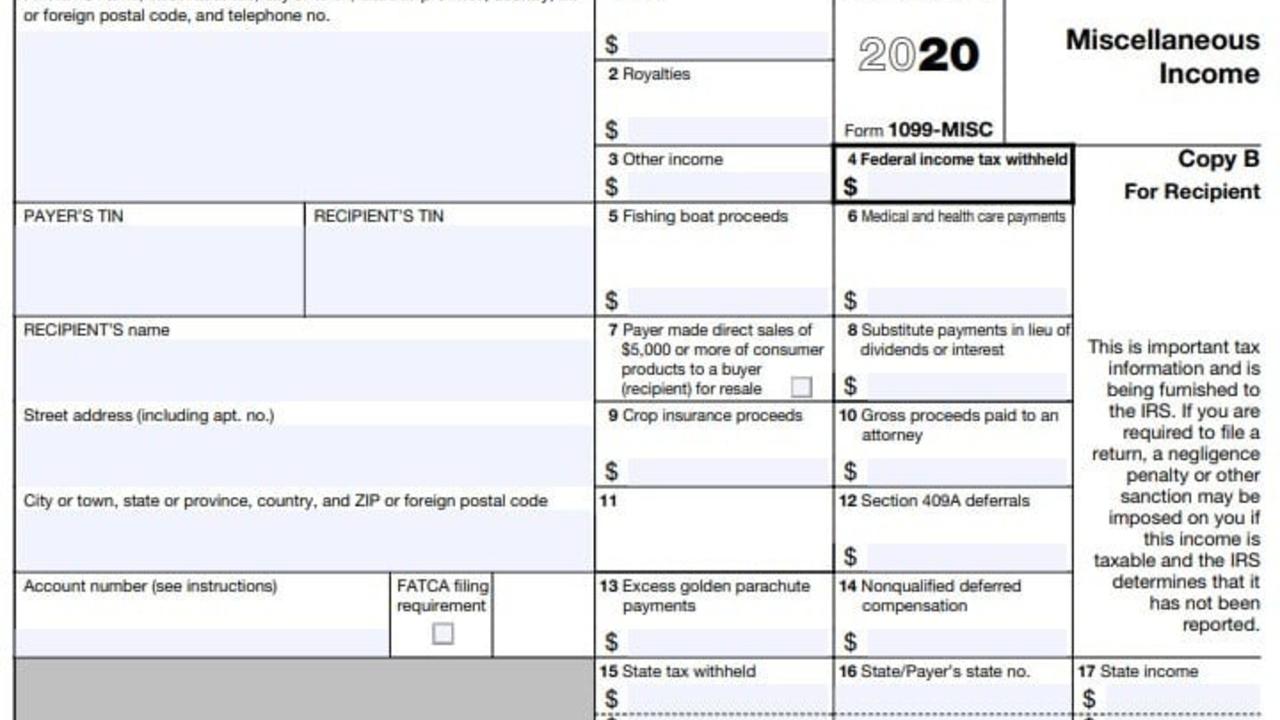

The 1099-Misc form is used to report non-employee income payments. If you only have regular employees, you’ll be giving them each a W-2 instead.

As a small business owner, it’s very likely that you will receive and send a 1099-Misc form at the beginning of the new tax year. These forms are used to show the IRS what you paid any non-employee workers and report income you received from business contracts.

Much Ado About 1099s

As a small business owner, there are several conditions under which you are required by law to send 1099s to your vendors or contractors:

- You paid them 600 dollars or more for:

- Rent

- Non-employee services performed (a contractor)

- Other income payments

- Attorney payments

- Several other specific transactions

1099 forms are one of the ways that bookkeeping will help you stay on top of your tax season responsibilities!

Deadlines and Fees

You are required to send out 1099s by the deadline of January 31st (or since it's a Sunday in 2021 - Februar...