All About 1099s

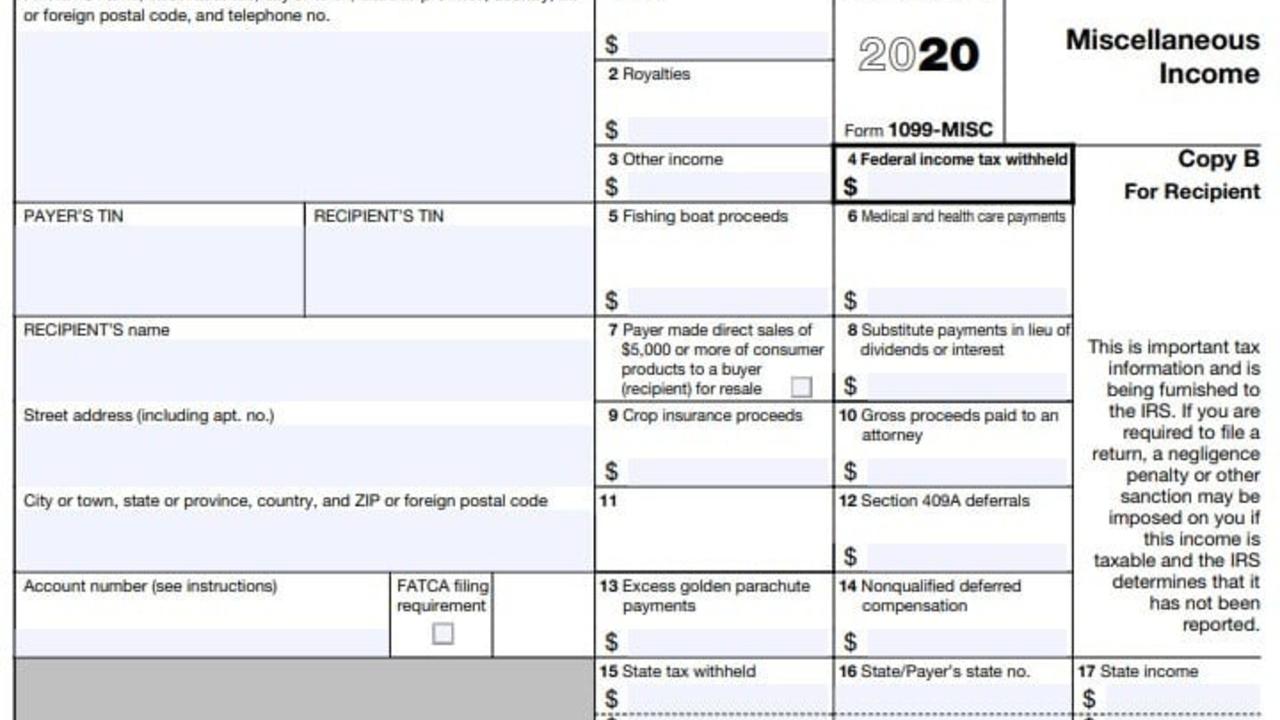

The 1099-Misc form is used to report non-employee income payments. If you only have regular employees, you’ll be giving them each a W-2 instead.

As a small business owner, it’s very likely that you will receive and send a 1099-Misc form at the beginning of the new tax year. These forms are used to show the IRS what you paid any non-employee workers and report income you received from business contracts.

Much Ado About 1099s

As a small business owner, there are several conditions under which you are required by law to send 1099s to your vendors or contractors:

- You paid them 600 dollars or more for:

- Rent

- Non-employee services performed (a contractor)

- Other income payments

- Attorney payments

- Several other specific transactions

1099 forms are one of the ways that bookkeeping will help you stay on top of your tax season responsibilities!

Deadlines and Fees

You are required to send out 1099s by the deadline of January 31st (or since it's a Sunday in 2021 - February 1st), the same deadline as the W-2, which is the form you would send to your employees.

Missing the deadline you can incur a fee of $30-$100 PER form, so you really don’t want to miss it!

Steps to Sending Your 1099

We want to provide you with a basic summary of how to get your 1099s out the door and into the mail, so here we go!

Check Your Work

You will need to have your books in order and completed W-9 forms from each of your contractors. If you need information from your contractors, it’s a good idea to get in contact with them as soon as possible.

Get Your 1099s

You can order the specialized 1099 forms from the IRS (Here), some office supply stores, or use specialized software to create them.

Fill out the Forms

You will need to include your business information, the amount of money paid, to whom, their contact information, and any taxes withheld.

Careful there is a NEW 1099 form for Non-Employee Contractors this year:

Send out Your Forms

You must mail them or hand them out to the contractors by the deadline.

Keep a Record

Copy C of each 1099-Misc form is the employer’s copy. Keep this for your records for both the IRS and your contractors.

We Hope to See You Next Time!

We’ll be back with the second half of our 1099 double feature with a Guide to Using QBO to Create 1099s shortly! As a small business, we know how stressful it is preparing for tax season and getting your paperwork in order. That’s why we want to provide you with a fool-proof guide to getting your 1099s done and out the door with as little stress as possible!

Let us know how you’re doing in our Facebook Group!

Disclaimer This article presents general information and is not intended to be tax or legal advice. Refer to IRS publications and discuss possible tax deductions with your tax preparer.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.