How to Find the Perfect Accountant

"How to Find the Perfect Accountant”

By Ellen Rohr & Meaghan Likes

As an experienced accountant in the trades I often get asked this question… “How do I Find a Good Accountant” and I always reply with a picture of the pages from Ellen Rohr's books called “Where did the Money Go” and "How Much Should I Charge" where she first published this list. (I usually include links to where they can buy their own copy.)

Well this year, after answering this question over 10 times in one week - I finally reached out to Ellen and asked her if I could take her witty list, add my personal thoughts & experiences and co-publish it as a blog post. She kindly agreed and so here we are…

How to Find the Perfect Accountant!

When it comes to managing your finances, having the right accountant is absolutely essential. A good accountant not only helps keep you organized (and out of trouble) but can help you make better (& faster) decisions. They can help translate sometimes complex ideas and they shou...

Sending Out your 1099s with Quickbooks Online

Small Business Owner’s Guide:

Sending Out your 1099s with Quickbooks Online

No one enjoys tax season, but as a small business owner, it can be especially stressful.

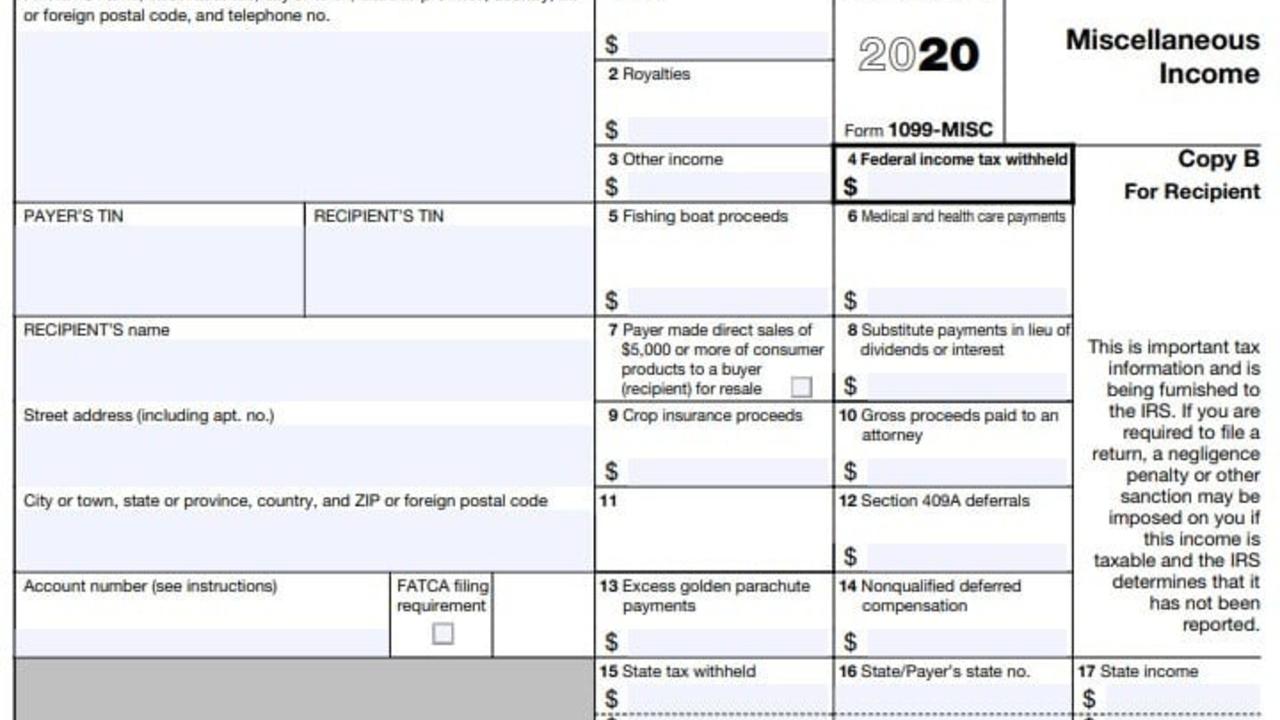

One of the most important things you need to do at the beginning of each calendar year is send out reporting forms to your employees and the IRS. If you pay non-salaried employees, contractors, or a variety of vendors for services, you will likely need to send out 1099-Misc forms to report these non-employee wages.

Luckily, Quickbooks Online is prepared to help you out, and we’re going to explain every step!

![]()

Preparation is Key

If you haven’t kept your books up to date for the previous year, you won’t be able to send out any forms for tax season. If you need help with that, you can check out our guides to bookkeeping basics in the blog section.

Once you’ve got all of your accounts reconciled and ready to go, double check that all of your transactions have payees filled in - this is crucial for the re...

All About 1099s

The 1099-Misc form is used to report non-employee income payments. If you only have regular employees, you’ll be giving them each a W-2 instead.

As a small business owner, it’s very likely that you will receive and send a 1099-Misc form at the beginning of the new tax year. These forms are used to show the IRS what you paid any non-employee workers and report income you received from business contracts.

Much Ado About 1099s

As a small business owner, there are several conditions under which you are required by law to send 1099s to your vendors or contractors:

- You paid them 600 dollars or more for:

- Rent

- Non-employee services performed (a contractor)

- Other income payments

- Attorney payments

- Several other specific transactions

1099 forms are one of the ways that bookkeeping will help you stay on top of your tax season responsibilities!

Deadlines and Fees

You are required to send out 1099s by the deadline of January 31st (or since it's a Sunday in 2021 - Februar...

What is Bookkeeping?

“So what is bookkeeping?”

Believe it or not that’s actually one of the most frequently asked questions we get. Small business owners seem to understand that it has to do with basic business finances, but what is bookkeeping really?!

Bookkeeping Basics

“Bookkeeping” is the act of recording financial transactions. Seems simple, right?

Well, wait a second, while we’re here… let’s break down the word “transactions” too, so we have the most basic building blocks of bookkeeping!

What is a Financial Transaction?

There are two general types of transactions you need to record for your bookkeeping, your expenses and your income. At the most basic level, you are recording the money that goes out of your business (an expense) and the money that comes into your business (your income).

Expense Basics

We need to record the money that goes out of our businesses so we can know what our working budget is. As a small business owner, you not only need to know how much money y...

How to Survive Coronavirus as a Small Business

5 Lessons our Small Business Learned During the Global Pandemic of 2020

Like many of you, I’ve spent the past 6 months fighting to rebuild our small business to be strong enough to survive coronavirus. We’ve redesigned our training programs, our marketing systems, our client communication tools and changed our entire business model to be able to keep a “safe distance” and ensure our staff and client’s safety.... And amazingly we've lived to tell the story.

Now, I'm not saying it was easy or that we've done things right (or even well), but we are coming out of 2020 stronger. Below are 5 things we did differently to pivot and stay profitable even after having to lay off all of our staff back in March and rehiring them in April.

Lesson 1: We got lean…

Like SUPER lean… like I threatened to only cook ramen and considered canceling our $14 per month spotify subscription lean…

Like SUPER lean… like I threatened to only cook ramen and considered canceling our $14 per month spotify subscription lean…

By getting intimate with our numbers we figured out how to cut our expenses with care and were able to ri...

Ready, Set, Responsibility: Taxes, Taxes, Taxes

So Many Hats, So Little Time

Choosing the self-employed career path gives you a lot of personal power, and as we know, with great power comes great responsibility.

And one of those responsibilities is paying your taxes... But, just because you’ve chosen to shoulder additional responsibilities as a small business owner doesn’t mean that your stress level needs to rise just as much as your commitments have! You can learn how to cover all of your bases without stretching yourself to a breaking point.

Taxation Before Vacation

One of the reasons tax season can be so stressful is because we try to ignore it for 11 months of the year. Running a business really requires you to be mindful of what and when taxes must be paid, and also how your income affects what you owe.

When you are aware of your tax obligations all year long.... tax season will no longer be a seasonal stressor, instead it becomes a review of what you’ve already done (and saved). For some it can even mean more cash a...

Insuring Success....

Insurance for the Inspired

In this day and age, you can insure just about anything. But understanding what your business vulnerabilities and insurance needs are sometimes confusing enough to make your head spin.

But.... When you do it right.... Your business won't only "survive" in the face of adversity, it can thrive!

In this week's blog post we're wanting to help make sure that you are prepared to face any challenges that may come your way... Below is an overview of the most frequently needed types of insurance coverage for small businesses.

With the help of a good insurance broker and the right coverage you can rest easy knowing you are covered.

General Liability Insurance: Every. Business. Needs. This.

General Liability insurance both defends and covers damages that could be claimed against your business for possible property or bodily damage.

Professional Liability Insurance: This is supplemental to General Liability Insurance, and helps cover claims against error, omissi...

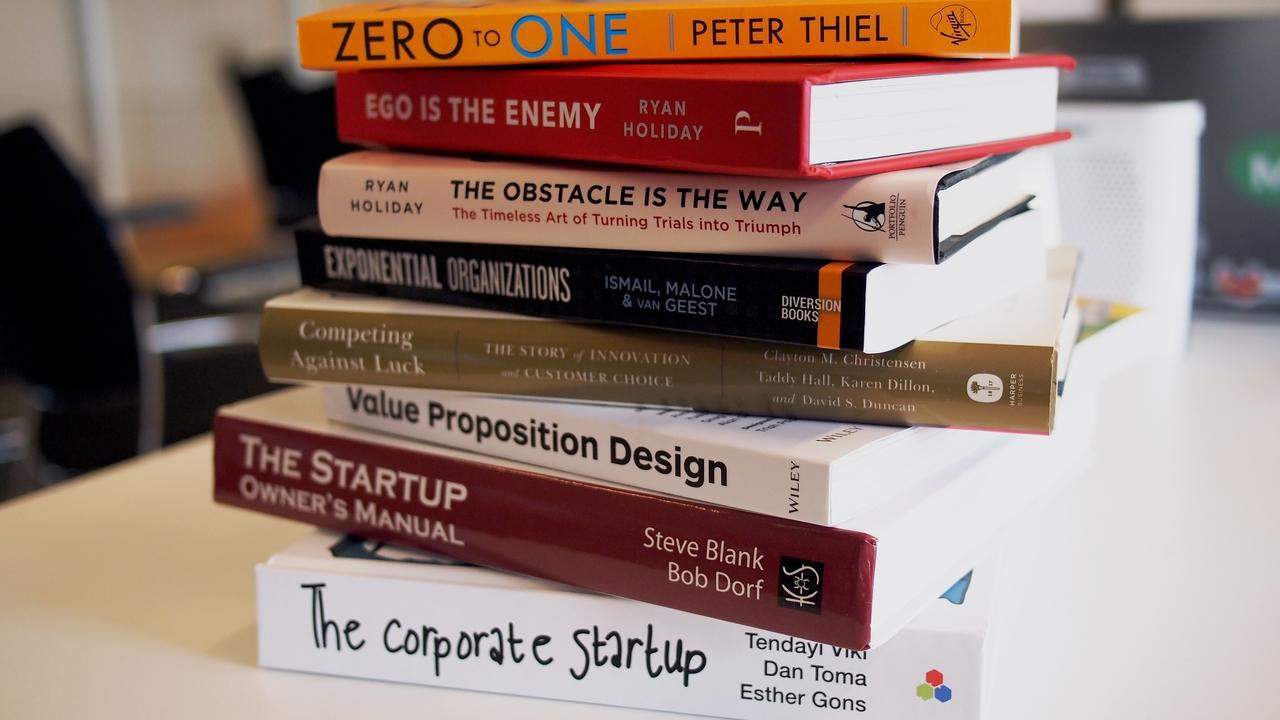

How Bookkeeping Makes Your Small Business More Profitable: Resources

Wow, we covered a lot of information in the last month. And for all that we did cover, there’s so much more information that we could have given you… but it would have been difficult to understand it all at once.

Profitability, in theory, is simple, but in practice, it takes time to understand and even more time (and plenty of energy) to apply your knowledge to your small business.

Let it never be said that we left you high and dry! We’ve got some wonderful resources that we use ourselves and also use with our relatively diverse set of small business clients.

Profitability Review

As we know by now, profitability isn’t just in the numbers, profitability is much more of a measure of your efficiency and ability to grow. More specifically, profitability is a measurement of how much profit you can make with a given set of resources and inputs.

We know that having a firm grasp on your expenses is the first step to understanding how your business is creating profit. You...

How Bookkeeping Makes Your Small Business More Profitable: Profits and Long Term Planning

So you’re making money and you’re happy… but what do you do next? Let’s discuss how you can use your net income to further your own profitability and lay the groundwork for long-term success!

Managing Profits and Savings

If you made it this far with no debt, you should not only pat yourself on the back, maybe you could tell us your secret - but for most small businesses, the first few years are more about staying afloat and learning the ins and outs of your new dream job.

Most of us have borrowed in some form or another to make sure we had the cash flow to maintain our business during its infancy. Now that we have secured net income and we understand how to make our services profitable - we can focus on managing our money efficiently!

If coming up with a Debt Reduction plan wasn’t part of your process for understanding your business expenses, than now is the time to do it! Pay from the highest interest rates first - these will also help free up your emotional energy so...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Customers and Increasing your Profitability

If you’ve been keeping up with our recent blogs you’ve already learned the foundation of small business profitability - your expenses and your income. Now it’s time to expand on this foundation to create sustainable changes in your business that lead to long term success.

It may seem like the above covers almost everything about making your small business more profitable, and we did cover a lot of very important things that will make you a smarter business owner, but there’s even more you can do to create an efficient and profitable business!

Knowing your Customers

Love, hate, or something in between, you need your customers for your small business to thrive!

When you’re just starting out, you’re thankful to have any clients, and you probably aren’t worried about retention or sales trends. But now, you’re smarter and you understand the money flowing in and out of your business - so it’s time to take your small business from successful to supreme.

So how do you go ab...